Why 2 out of every 5 tariff codes are typically wrong

And what it’s costing you... Tariff codes might look like a routine administrative step when you’re preparing goo...

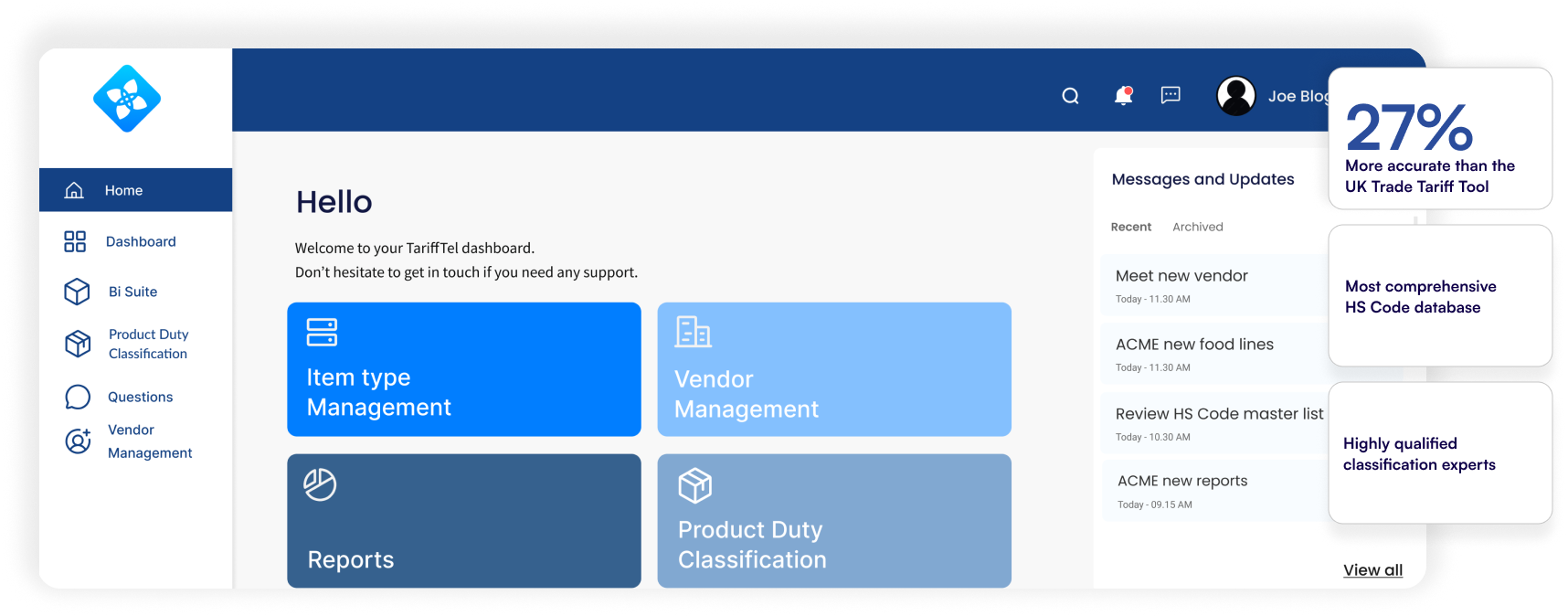

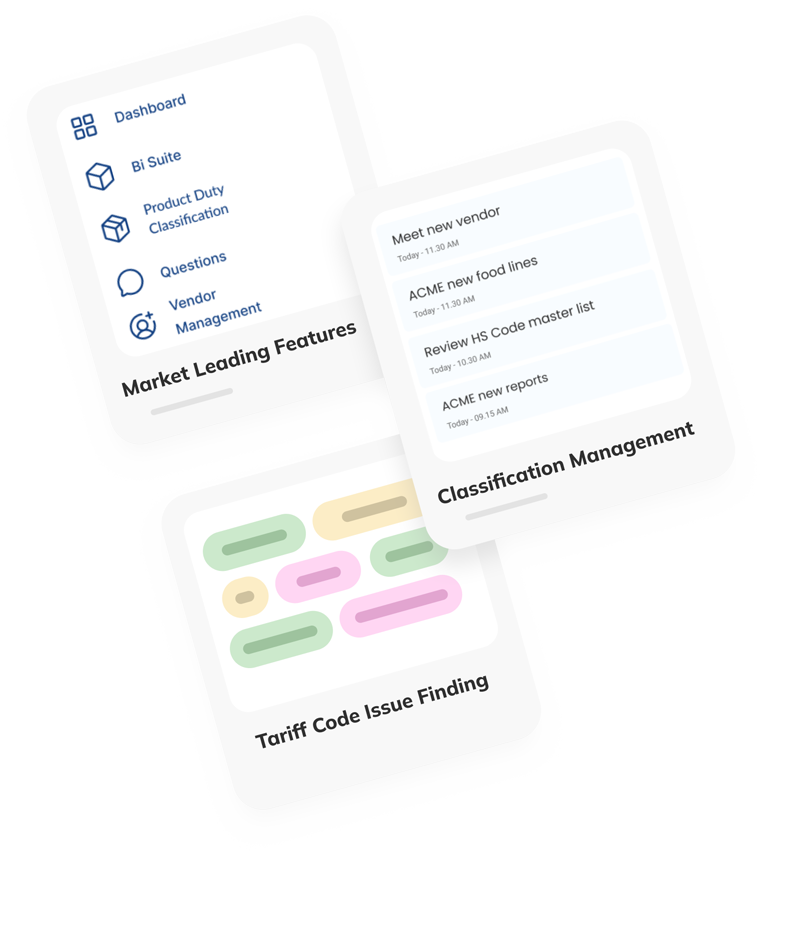

Unbeatable tariff code accuracy, duty rate assurance and cost savings when classifying products

Request a Demo

These businesses rely on TariffTel everyday for accurate tariff codes

Accurate tariff codes help your trade operations to run smoothly and efficiently. With accurate HS codes, you benefit from:

An uninterrupted and quick moving supply chain

Compliance with trading rules & regulations

Assurance you pay the right duty amount

Customs classification solutions like TariffTel make assigning accurate tariff codes for products easy and quick. You improve compliance standards, receive a full audit trail of your products and keep up-to-date with code changes.

With TariffTel, you benefit from the highest standard in customs classification. You’ll soon see why it matters.

Your suppliers know your products best, they are the gatekeepers to all product data. Collecting this data at source through simple data input unlocks the key to unbeatable tariff code accuracy. Easy input, securely shared and maintained by TariffTel.

There’s many moving parts in a supply chain that can cause deep-rooted disruption. Don’t let tariff codes be one of them. Shipments with accurate tariff codes pass through border controls quickly and easily, reaching their destination as planned without delay.

Customs rules and regulations are complex and vary significantly by country. It’s easy to be caught out and face fines and prosecution from customs authorities if you misclassify goods. Our highly experienced team maintain our system and are with you through every classification.

In our experience, many businesses unknowingly pay more than they need to in duty costs. We help businesses pay the correct amount, and automatically maintain tariff codes for them when they change due to updates. Under-paying duty means fines to cover the gap.

Discover the transformative capabilities of TariffTel for yourself when you gain absolute visibility and control of your classification process

And what it’s costing you... Tariff codes might look like a routine administrative step when you’re preparing goo...

As we head into 2026, another round of tariff book changes have come into force. Many relate to electricals and chemical...

Tariff classification for food and drink products is rarely simple. Exporters dealing with composite goods, processed in...