Why does every product need a tariff code?

Topics

Whether you’re shipping one or a thousand products across borders, every product has to be assigned a specific tariff code, also known as a Harmonised System (HS) code. The Harmonised System (HS) is an internationally standardised system of names and numbers for classifying traded products. It was developed by the World Customs Organisation (WCO) and is used by more than 200 countries to assign HS codes. These codes are essential for categorising products, assigning the correct duty rate and ensuring smooth cross-border transactions.

We see firsthand how critical these codes are for businesses of all sizes. Our TariffTel solution has been designed specifically to make the classification process streamlined and simple to navigate – classification needn’t be a huge burden for businesses.

In this blog, we look at why every product needs a tariff code, the purpose of a tariff code, some common terminology used and also the consequences of getting it wrong.

Why tariff codes matter

Tariff codes are the backbone of international trade. They classify goods in a standardised manner, ensuring compliance with international trade regulations.

Elizabeth Davies, TariffTel Custom Systems Manager, says, “Accurate tariff codes are crucial for determining the correct duties, taxes, and regulations applicable to a product. It’s a non-negotiable in trade today, businesses have to get their tariff codes right every time or they face some quite severe repercussions.”

Elizabeth Davies, TariffTel Custom Systems Manager, says, “Accurate tariff codes are crucial for determining the correct duties, taxes, and regulations applicable to a product. It’s a non-negotiable in trade today, businesses have to get their tariff codes right every time or they face some quite severe repercussions.”

The job of a tariff code is to determine the tariff rates that apply to the goods, as well as to facilitate trade by enabling customs authorities to identify and track shipments.

But, there are a few variations of a code you may see which can make things confusing. Often you will come across terms such as HS codes, HTS codes, and Tariff/Commodity Codes.

Common tariff terminology explained

What is the difference between the different terms?

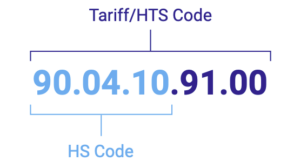

HS Codes: HS codes are six-digit codes that classify goods based on their nature, form, and composition. The first two digits of a HS code identify the chapter, the next two digits identify the heading, and the final two digits identify the subheading. Read more about HS codes.

Tariff Codes/Commodity Codes: Tariff codes or commodity codes are classification codes used to determine the customs duty that is applied to a particular product. These codes are ten digits long for imports, eight digits for export, and are used to identify specific products. The HS code makes up the first six digits whilst the final four digits are unique to each country’s tariff system, and they provide additional detail that is specific to that country’s classification systems.

HTS Codes: In the US, the Harmonised Tariff Schedule (HTS) is maintained by the U.S. International Trade Commission (USITC) and is used to determine the tariff rates that apply to goods imported into the United States. The WCO provides the first six digits and the HTS US provides the final four for additional detail. Each country maintains its own Harmonised Tariff Schedule (or similarly named).

What happens when a tariff code is wrong?

A common misconception is that there’s minimal consequences when a tariff code is wrong. The opposite is in fact true. A misclassified product can have far-reaching consequences across a business’ entire supply chain from border delays and fines to damaging relationships with important suppliers.

In our own research, we found that 2 in every 5 tariff codes used is incorrect. This is a staggering figure when you think of the thousands of businesses this applies to.

One of the biggest repercussions of incorrect tariff codes is the under-or-over payment of duty. If a business is found to be paying the wrong amount, they may have to repay the shortfall that should have been paid to customs authorities in the first place. Going through the audit process is complex and time-consuming which takes up a vast amount of resource. Additional costs like conducting internal audits, hiring customs experts or consultants and possibly engaging legal support all add to the complexity of rectifying these situations.

Penalties and fines can be imposed by HMRC as a result which can put a strain on company finances.

Read more about what happens when tariff codes are wrong here.

Support for getting tariff codes right

At TariffTel, our combination of advanced customs data and our unrivalled team expertise creates a precision solution for every business prioritising trade efficiency and growth. Our easy-to-use solution automates the process and puts data at your fingers tips to make classification easier.

We think classification should be made simpler for everyone and have created many resources on our website and blog. Our latest guide is designed to help you understand what data you need about your products, to get the correct tariff code. We’ve called it ‘The devil’s in the data’ and there’s a webinar to watch in partnership with The Institute of Export & International Trade, and a helpful downloadable guide. Get access here.

If you want to find out more about a tariff code solution that’s right for your business or want to learn how your business could benefit from TariffTel, get in touch with our team.

Other Useful Resources

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...