Picky about your picnic food classifications?

Topics

Everyone enjoys a picnic, but do you enjoy classifying picnic products as much as eating them? When it comes to classifying picnic goods it pays to be picky with the detail to determine the correct tariff code. With accurate codes comes compliance with trade regulation and you ensure your shipments arrive promptly at their destination so your picnic foods are as fresh as can be.

Here, we look at a selection of some of the most popular picnic treats, and some more unusual ones, which may cause confusion.

Take a look a more food classifications we unravel on our BBQ blog.

Tariff codes for fresh strawberries

No picnic is complete without a punnet of fresh strawberries and thankfully, classifying fresh strawberries is relatively straightforward. They fall under “Other fruit, fresh – Strawberries” in the tariff book. However, the challenge lies in ensuring the strawberries are indeed classified as fresh and not preserved or prepared, which would alter the tariff code. For fresh strawberries, the tariff code is 0810100000.

Tariff codes for fresh blueberries

For blueberries, the challenge is identifying the exact species. Accurate species identification is crucial since European blueberries, highbush blueberries, and other species each have distinct codes. Misidentification can lead to non-compliance and potential penalties.

Do you know your European from your highbush? Here’s the tariff codes you need to know.

Do you know your European from your highbush? Here’s the tariff codes you need to know.

• 0810403000 – European Blueberry – Of Species Vaccinium myrtillus

• 0810405000 – Highbush Blueberry – Of Species Vaccinium corymbosum

• 0810409000 – Not of Species Vaccinium myrtillus or Vaccinium corymbosum

How to classify mixed fresh salad with vinegarette dressing

Typically, fresh vegetable mixtures are classified by the predominant vegetable. However, adding vinegarette dressing reclassifies it as a prepared mixture under heading 2005. Taking account of all ingredients and preparation techniques just highlights how important this extra detail is to determine the correct classification.

The tariff code for prepared Mixed Vegetable Salad is 2005995090

Cheesecake bomb anyone?

For that wow factor at a picnic, how about a cheesecake bomb? This can be complex to classify due to its unique composition. Unlike traditional cheesecakes that fall under heading 1905, this product lacks a biscuit base and includes white chocolate. Therefore, it is more accurately described as a dairy-based dessert under heading 1901.

Pre-Made Sangria Carton

And finally drinks at a picnic? How about Sangria.

Sangria classification is intricate due to its wine content and additional flavourings. Though it may seem to fit under heading 2204 (wine), the WCO Explanatory Notes and Additional Chapter Notes direct it to heading 2205. This example highlights the importance of thorough regulatory knowledge to navigate classification correctly.

Classifying picnic products involves meticulous attention to detail and a deep understanding of trade regulations. Thankfully, our TariffTel solution is designed to get into the detail and support you in determining the correct tariff code every time.

Other Useful Resources

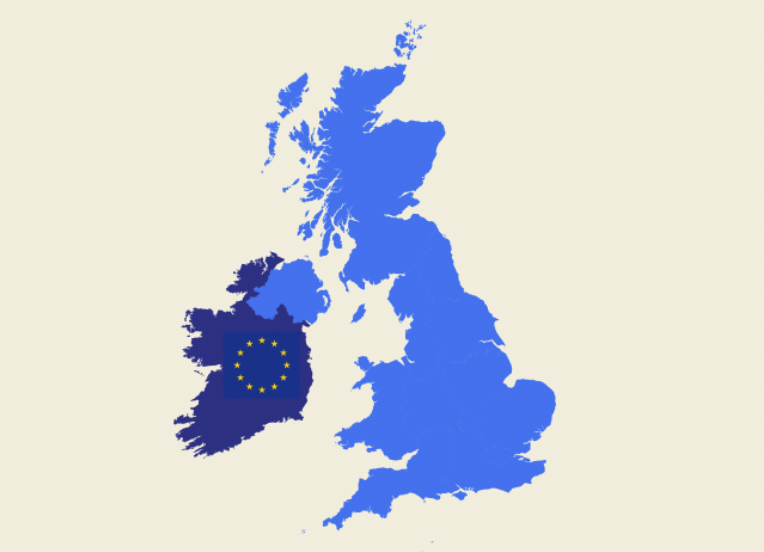

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...