Five benefits of implementing TariffTel, according to our customers

Topics

Customs compliance is a complex arena with a multitude of regulations, tariffs, and duties that businesses must navigate when importing or exporting goods. One of the most important aspects of this process is ensuring the correct classification of goods. Misclassification can lead to costly errors, shipment delays, fines, and can even cause damage to your business’ reputation.

At TariffTel, we specialise in helping businesses navigate these complexities by providing comprehensive, accurate customs classification solutions. Alongside expert advice from classification specialists, our robust TariffTel system means you take the guess work out of classification and your business can save time, money and hassle when it comes to shipping products internationally.

The high price of assumption in customs classification

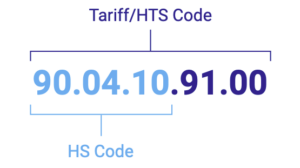

Goods classification is more than just ticking a box. Every product shipped across borders needs to be assigned a specific tariff code. These codes dictate the customs duties payable, any restrictions, and the documentation required. Read more about codes and their importance here.

The main problem we see many businesses face is assuming they can simply assign codes based on a quick assumption of what their product is. That approach is rife with risk. A slight misinterpretation or a rushed classification could have significant consequences, ranging from overpaying on duties to facing penalties for non-compliance.

We recently spent time looking at some common misclassification mistakes where assumptions are easily made about seemingly simple products. Take camping products for instance, or school equipment.

Here’s where having a solid customs classification solution, like the one we offer at TariffTel, comes into play. Nothing is taken for granted and classifications are made based on accurate product data that takes every detail of a product’s composition into account.

The benefits of implementing a robust, trusted classification solution far outweigh any initial minor upheaval in introducing a new approach within an organisation.

As David James, Group Supply Chain Director at boohoo Group PLC, can testify, “This solution was transformative for boohoo group, we capture all the data required from suppliers for classification that produces the full 10 digit US HTS code. This innovation has ensured the smooth flow of goods through US Customs and since the distribution centre opened we have had zero shipment delays on products entering the US.”

As David James, Group Supply Chain Director at boohoo Group PLC, can testify, “This solution was transformative for boohoo group, we capture all the data required from suppliers for classification that produces the full 10 digit US HTS code. This innovation has ensured the smooth flow of goods through US Customs and since the distribution centre opened we have had zero shipment delays on products entering the US.”

Read more directly about boohoo’s use of TariffTel.

Here are the five key benefits our customers tell us they experienced when they introduced TariffTel

1. Preventing costly mistakes

One of the biggest challenges in customs compliance is ensuring that products are correctly classified from the outset. Making assumptions about product classification can lead to costly mistakes. For example, an incorrect HS code can result in paying too much or too little in duties, which may trigger audits, penalties, or shipping delays.

A reliable customs classification solution takes the guesswork out of the process. At TariffTel, our system is designed to meticulously analyse product details, ensuring the right HS code is applied. This level of accuracy helps you avoid costly errors and ensures compliance with international trade regulations.

2. Staying on top of changing regulations

Global trade regulations are constantly evolving. Customs classifications and duty rates can change frequently based on international agreements, national policies, or economic shifts. Relying on outdated assumptions or manual methods to classify products could leave you non-compliant and lead to penalties and fines.

Our experts monitor these changes so you don’t have to. Our solution is continuously updated with the latest regulations, and updates to tariff codes keeping your business in line with the most current requirements. That means you can rest assured that your classifications will always be accurate and up to date.

3. Saving time and streamlining operations

Manual customs classification can be a time-consuming process, especially for businesses dealing with a large number of products or frequent shipments. Often, we see businesses using spreadsheets to record tariff codes and master product data which means manual errors are common and teams often mistrust the data they rely on to classify, not having the assurance it is kept fully up to date. To be accurate in classification, each product needs to be meticulously analysed and documented to avoid errors.

With TariffTel’s automated customs classification system, you can streamline this entire process. We have delved into the intricate terms associated with products, and designed our Item Types to be user-friendly. We eliminate the need for extensive research when classifying. By reducing research time and the need for manual input, our system not only saves time but also boosts productivity by allowing teams to focus on core business activities rather than getting bogged down in administrative work. This ensures your classification is accurate, done quickly and that you adhere to regulatory standards.

4. Reducing compliance risks and penalties

Customs compliance is a strict field, and non-compliance is often met with hefty fines or penalties. This could range from monetary fines to shipment delays or even confiscation of goods in extreme cases. The consequences of non-compliance can damage a company’s reputation and relationships with partners and customers.

Using an expert customs classification solution minimises these risks. A proactive approach helps prevent unwanted surprises during customs checks, giving you peace of mind that your classifications are accurate. A big part of this is maintaining a comprehensive audit trail. With TariffTel, every classification decision, consultation, and document generation is logged and tracked, providing transparency and accountability for compliance purposes.

5. Building a competitive advantage

Accurate customs classification doesn’t just help with compliance—it can also offer a competitive edge. With the correct codes and knowledge of applicable trade agreements, your business may be able to reduce duties, take advantage of preferential tariffs, or streamline your shipping processes. This can improve your pricing and margins, making your products more competitive in global markets.

TariffTel’s system is designed to identify these opportunities, ensuring that your business isn’t just compliant but also optimally positioned to benefit from international trade regulations.

Customs compliance can feel overwhelming, but it doesn’t have to be. By leveraging the right expertise and a trusted solution like TariffTel, you can simplify the process, avoid costly errors, and ensure your business is fully compliant with the ever-changing landscape of international trade. Don’t make the mistake of assuming anything about your products again to determine tariff codes, speak to our team to find out more about how TariffTel takes the guesswork out of the process.

Other Useful Resources

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...