Five key considerations for international trade for 2024

Topics

What is the number one trade challenge for businesses trying to ship their goods internationally?

Data – collection, accuracy and validation. This was the number one challenge raised by almost all visitors to our stand at the recent Import Export Show, hosted by the Institute of Export & International Trade. And it doesn’t come as a surprise to us.

Our team were not only talking about our TariffTel solution and how it is transformative for businesses in collecting and managing data to classify goods, but had their ear to the ground finding out more about the hot topics we’re all talking about as we get ready to enter 2024.

The event was bustling with people looking to get ahead in international trade, coming armed with questions and insights on how trade can be improved and what’s not working. Importantly, people were there to discuss solutions to overcome the current barriers they’re facing, with classification being just one of them that we can help with.

Having listened to the director of the IOE&IT, Maro Forgione, heard from knowledgeable attendees, along with government ministers, as well as academics and key thinkers involved in international trade, here are our five key takeaways to inform your approach to trade in 2024.

Five key takeaways to inform your approach to trade in 2024

1) The UK Government wants the UK to have a more effective trade border, or most effective compared to what it is now, and compared to other countries’ trade operations – a big, but noble, ambition in our opinion and one requiring considerable change and innovation. With the goal to make trading with the UK quicker, safer and more cost effective, it will take the cooperation and knowledge of the whole industry, as well as a willingness to adopt new developments in technology, to set changes in motion to give the UK border that reputation in the near future.

A comment in one of the morning discussions was around how freely the notion of ‘free trade’ is spoken about, but the reality is that businesses today are operating within ‘managed trade’ confinements due to a high amount of documentation needed and a lack of digitalisation that is holding UK trade back.

2) Data collection, accuracy and validation of data in trade operations is a challenge for many businesses still. This was a challenge raised by almost all visitors to our stand. Businesses are struggling in two ways, both of which are equally problematic: They don’t know where to get the data they need from, and it takes too long to receive it when they do. In either scenario this can potentially lead to incorrect tariff codes and wrong duty payments which in turn, results in shipment delays leading to loss of sales and even fines by HMRC. It all starts with data. Many people we spoke with understood that incorrect data can have these dire consequences and were looking for a solution to improve their data accuracy and compliance. This is where our tariff code solution TariffTel comes in to support businesses in working with their suppliers to collect and record accurate data in the first instance, which enables the correct tariff codes and duty payments to be assigned.

3) ‘Small, but nimble’, this was a sentiment that came up several times at the event by policy experts describing the UK’s force in global trade. Rather than trying to compete with the world power of the trade bodies of the EU or US, the UK as a standalone trading country, needs to retain its importance as a ‘friend to all’ like Switzerland. It was also agreed by policy experts that with the reduced influence as a global rule-setter, the UK should instead look to reorient itself as a ‘smaller, more nimble’ country. What this means for British business we think is open to interpretation and we certainly see nimble as being interchangeable to agile. If businesses are able to be more agile in their operations, they can respond quicker to opportunities, and also deal with challenges quicker. Technology can provide great support here in streamlining processes and managing data for the necessary paperwork. Ultimately, the UK’s force in global trade is going through a period of change as the UK looks to live up to this new way of trading as a standalone trading country.

4) The international market has huge potential for UK businesses and it doesn’t pay to play it safe and trade only in the UK. There was a fascinating panel discussion on ‘What international trade has done for my business’ which involved a range of businesses discussing how they are now exporting more than selling into the UK. The huge success of Fever Tree was held up as a great example as a British business that is now enjoying strong success in the US market. It was great to hear from all of the panel who talked about taking risks in international trade rather than staying safe and just trading in the UK. All of them have seen a huge increase in business by opening up to international markets.

5) Always look for the opportunities in international trade as you never quite know where they will come from, and do your research on new markets. This was the main message from Barry Tong Sol Retail at the Import Export Show who started out with £10 and converted it to £10 million in 10 years. Quite a success story. After starting out selling on ebay, he was quickly approached by Amazon and soon became one of Amazon’s top 100 sellers. He works with brands to help distribute their products to 16 other countries and this really started to take off during and after the pandemic when online retail sky-rocketed and he was able to meet consumer demand with the products he distributed. But, whilst he took advantage of the opportunity, he was also faced with the challenge of exporting to many different markets: each country has their own customs rules and regulations that you have to adhere to. For example, when exporting to France, they have a number of banned ingredients which means goods with these ingredients cannot be shipped there.

How are you preparing your business for the trade challenges and opportunities ahead?

If your business has the challenge of data, like the many we spoke to at the Import Export Show, and you want to understand how you can better collect and manage data as part of your customs classification approach in 2024, please get in touch with our team. We’ve saved many British businesses from paying incorrect duty costs and ensured their shipments stay on track, we can help you too.

Read more about another important issues concerning the industry right now, compliance, why it’s important.

Other Useful Resources

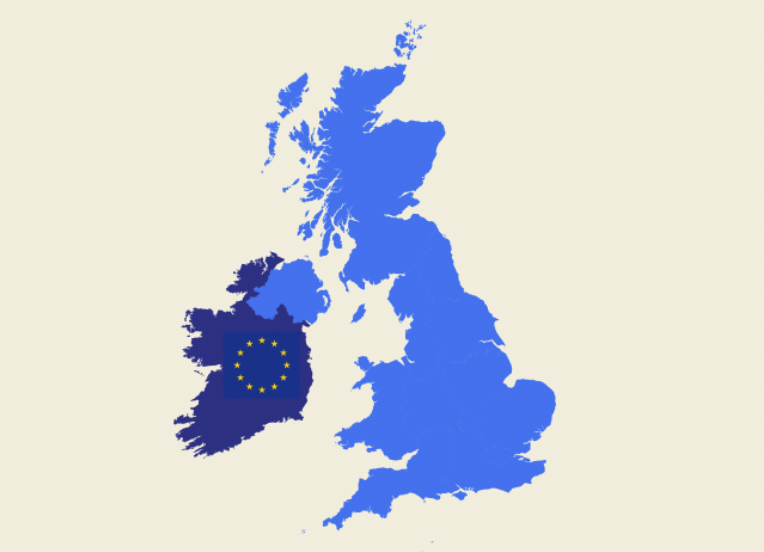

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...