How technology integration is transforming customs classification

Topics

In today’s rapidly evolving global marketplace, the successful adoption and integration of a customs classification solution has been a game-changer for many businesses across a range of industries including retail, manufacturing, FMCG and automotive. It offers unprecedented opportunities to streamline operations, enhance tariff code accuracy, and significantly improve compliance standards.

Our Head of Infrastructure and Technology, Tim Ingram-Smith spoke about how technology is having a transformational impact on supply chains and customs procedures at the recent Customs Compliance Conference in London. His discussion covered the state of the industry from a systems integration point of view and examined the steps businesses move through as they transition from manual processes, to simple file exchanges and uploads, through to where the industry is currently in the use of Application Programming Interfaces or APIs.

In this blog post, we’ll delve into how technology integration is reshaping customs classification including a specific example of how our TariffTel system has supported boohoo group PLC in transforming their classification approach. We’ll look at the challenges that come with it and how to navigate integration seamlessly.

Challenges with integration in customs classification

Integrating technology into customs classification processes comes with its fair share of challenges. One significant hurdle is the complexity of data management. Customs classification requires meticulous attention to detail, with accurate and up-to-date information about a product being paramount. Ensuring the seamless flow of data across various systems and platforms while maintaining data integrity can be a daunting task for many businesses whether they are shipping clothes, machine parts or pet supplies. The master data held on each product can vary significantly and is best gathered at source with suppliers, who know your products best. The ‘make-up’ of a product, be it fabric composition, fat or sugar content with food products or metal type with car parts, are all crucial pieces of information that need to be shared and regularly updated on your customs classification system and this level of source detail can prove challenging to collect.

Our TariffTel solution is a centralised auditable system that gathers essential product data from across your supply chain. By leveraging the information already contained within your business and combining our customs experts’ industry knowledge, we offer unbeatable accuracy and compliance standards in tariff code classification knowing the data we’re using is verified and accurate to begin with. Ultimately, accurate classification ensures you pay the correct duty and avoid delays at the border.

Our TariffTel solution is a centralised auditable system that gathers essential product data from across your supply chain. By leveraging the information already contained within your business and combining our customs experts’ industry knowledge, we offer unbeatable accuracy and compliance standards in tariff code classification knowing the data we’re using is verified and accurate to begin with. Ultimately, accurate classification ensures you pay the correct duty and avoid delays at the border.

Another challenge is navigating the regulatory landscape. Customs regulations are constantly evolving, with new requirements and tariff code updates and changes introduced by the World Customs Organisation regularly. Businesses need to factor in an approach that ensures they keep up to date with these changes and ensure compliance at all times. Being caught out with a tariff code change can have disruptive consequences across your supply chain. One of the main benefits of a solution such as TariffTel is that it is constantly maintained by our customs experts. Any changes to the Tariff are reflected within our system and communicated to clients as soon as the information becomes available, preventing the risk of misclassification.

One final challenge is the cultural shift within an organisation to embrace new technology and a different way of working. This re-education and training on a new system can slow down the integration process and mean it can take time to see the full impact of the new system in action. Sometimes cost overruns and delays occur as technical issues can arise during the integrating process but by involving the full team in the integration process, and planning a thorough on-boarding programme, these delays and additional costs can be minimised.

3 ways to make integrating a new system easier

1) Prioritise quality data: Prioritise data quality by investing in robust data management and security practices. Often teams are faced with classifying items using poor and insufficient data, or relying on codes provided by suppliers. TariffTel enables the capture of relevant data at source and provides storage in a centralised, secure data hub, giving teams access to a full audit trail. By ensuring data accuracy at source with your suppliers, together with completeness of data, and consistency across all sources and systems, you can implement data validation processes that identifies and rectifies errors early on.

2) Thoroughly assessment of needs: Before integrating a new system, it’s important to conduct a comprehensive assessment of your organisation’s specific needs and requirements when it comes to classification. By understanding the types of goods being classified, the volume of transactions, and the regulatory environment in which your business operates, you will be in the best position to ensure your new system is set up for your requirements.

3) Provide comprehensive training: Offer comprehensive training programs to educate employees on your new customs classification system. It’s important to provide a range of support options to suit the different teams involved in the classification process including hands-on training sessions, user manuals, and ongoing support to empower employees (including suppliers) to use the system effectively and confidently. At TariffTel, we’re proud of the access we provide to our customs classification experts who can help with the most complex of classification queries. They are well known amongst all our customers who appreciate their tenacity and skill in finding a solution.

How TariffTel has transformed customs classification for boohoo group plc

We have supported many businesses in expanding into new overseas markets and one of the those businesses is fashion retailer, boohoo group plc. In 2022, boohoo’s aim was to boost sales in the US and streamline the delivery of its fashion products to their new US distribution centre from the UK which was currently taking 8-10 days to arrive from the UK. Our TariffTel system supported them in their new approach to customs classification, prioritising customs compliance and accuracy.

We have supported many businesses in expanding into new overseas markets and one of the those businesses is fashion retailer, boohoo group plc. In 2022, boohoo’s aim was to boost sales in the US and streamline the delivery of its fashion products to their new US distribution centre from the UK which was currently taking 8-10 days to arrive from the UK. Our TariffTel system supported them in their new approach to customs classification, prioritising customs compliance and accuracy.

Their first challenge was to quickly and accurately classify thousands of SKU’s, a complicated task given they stored only partial product master data. Further difficulty lay with the complexities of the US customs controls which vary significantly to the UK.

In a short space of time, the team achieved a 100% compliance record on 20,000 SKUs, transforming the way US operations and classifications were conducted. The initiative reduced transit times, enabling boohoo group to fulfil demand more precisely in the growing US market.

Read more about how boohoo transformed classification with TariffTel.

Find out why compliance matters to boohoo group and other businesses in our blog on the impact of greater compliance.

TariffTel’s combination of customs data and our unrivalled team expertise create a precision solution for every business prioritising trade efficiency and growth.

If you want to find out more about a tariff code solution that’s right for your business or want to learn how your business could benefit from TariffTel, get in touch with our team.

Other Useful Resources

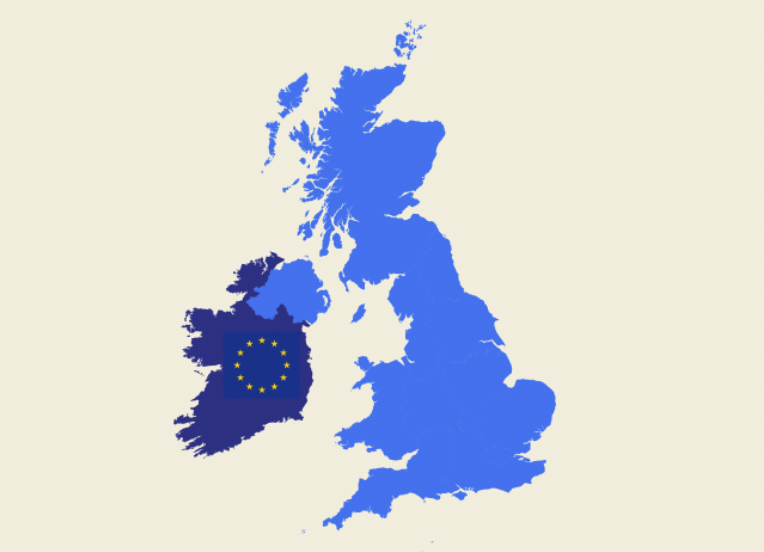

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...