How to classify common camping products

Topics

Camping is back this Summer, let’s just hope we have the weather for it! Whilst camping is popular with families and friends, it’s also a popular and much loved season for retailers. However, classifying camping products for shipment can be just as intricate as pitching a tent in the dark.

Today’s camping products come in a variety of forms and functionalities, which, while fantastic for outdoor enthusiasts, can be a challenge for those tasked with classification. Here, we delve into some camping examples to illustrate this complexity and provide some top advice along the way.

What’s the tariff code for a tent?

Choosing the right tent can be quite the adventure with so many options available, especially when considering play tents for young children. These versatile play tents can be used both indoors and outdoors, and this is an important element to consider when determining your tariff code.

If you are using the Tariff Book to classify a tent, you’d typically head straight to Chapter 6306 – Tents (including temporary canopies and similar articles), which carries a duty rate of 12%. But there are some important exclusions tucked away in the Chapter Notes that you need to be aware of.

The Chapter Notes to 6306 specifically excludes certain items, referencing articles from Chapter 95, which includes toys, games, sports equipment, and nets. While these notes don’t explicitly mention “tents” the World Customs Organisation (WCO) Explanatory Notes do. They clearly state that play tents for children, whether used indoors or outdoors, are excluded.

So, a children’s play tent that can be used both inside and outside should actually be classified under Chapter 9503. If it’s made of polyester, the correct tariff code would be 9503009900, which has a duty rate of 0%. This is a significant difference when compared to using Tariff Code 6302220000, which has a 12% duty rate.

To avoid these kinds of misclassifications, TariffTel can be incredibly helpful here. TariffTel provides specific item types for camping tents and outdoor play tents, complete with guidance notes that explain the relevant exclusions from the Chapter Notes and the WCO Explanatory Notes. This ensures you always get the tariff code right and avoid unnecessary duty payments.

Classifying tools

When it comes to pitching a tent, a mallet is a must-have tool. Trying to secure tent pegs by hand can be an impossible task! Imagine you have a mallet with a wooden handle and a rubber head. How would you classify this for customs duty purposes?

Referring to the tariff book, you might look at several chapters; Chapter 4417 covers tools of wood with 0% duty, Chapter 4016 includes articles of vulcanized rubber with a 2% duty, and Chapter 4017 deals with articles of hard rubber, which also have a 0% duty. As you can see, it’s easy to end up with the wrong code.

For composite goods made up of different materials, you need to apply the General Rules of Interpretation (GRI’s). Specifically, GRI 3(b) requires us to determine which material gives the mallet its essential character. In this case, we need to consider the role of each material in the mallet’s use. The rubber head is the part that strikes the tent peg into the ground (working edge), making it the “essential character” of the mallet. The correct classification for the Mallet would fit to either Chapter 4016 or 4017 dependant on the type of rubber, Vulcanised or Hard Rubber.

Without a solid understanding of the GRI’s, it’s all too easy to choose an incorrect tariff code and either underpay or overpay on duty. Fortunately, with TariffTel, the GRI’s are clearly explained within our Item Type selection process, ensuring accurate classification every time.

Classifying multiple product sets

Often, teams are asked to classify a multi-tariff set that contains various different products. Sets are not always easy to get right and can lead to misclassifications and significant over or underpayments of duty. Here’s an example of a cooking utensil set with storage bag which contains the following items:

Cooking Utensil Set with Storage Bag

– Knife Stainless Steel

– Tongs Stainless Steel

– Scissors Stainless Steel

– Barbecue basting brush – Stainless Steel/Plastic

– Ladle Stainless Steel

– Chopping Board (Plastic Silicone)

– Storage Bag/Case with specific slots to hold each utensils – Plastic Sheeting

When classifying sets you need to follow the GRI’s rule 3b to firstly determine if the set meets the rules of classifying to a single tariff or multi tariff set. There are three key rules that need to be met in order to classify as a single tariff set, and then you will need to determine which product in the set is to be used for the single tariff classification and you can then apply GRI rule 3c.

This set meets the rules of GRI 3b to be classified as a single tariff set because:

– The set consists of at least two different articles which are classifiable in different headings

– The set is put together to meet a particular need or carry out a specific activity

– The set is put up for sale in a manner suitable for sale directly to users without repackaging

Now that we have determined this can be a single tariff set, we must now consider the essential character of the set, this may be determined by factors such as value, quantities, importance etc. If no single product can be determined as an essential character, we have to follow rule 3c and classify to the product which occurs last in numerical order. Based on the below classifications, you can see that dependant on the outcome of rule 3c, the tariff duty can vary significantly so it is important to follow the rules carefully.

Knife Stainless Steel – 8211 – 8% Duty

Tongs Stainless Steel – 8215991000 – 8% Duty

Scissors Stainless Steel – 8213 – 0% Duty

Barbeque basting brush – Stainless Steel/Plastic – 9603 – 2% Duty

Ladle Stainless Steel – 8215 – 8% Duty

Chopping Board (Plastic Silicone) – 3924 – 6% Duty

Storage Bag/Case – Plastic Sheeting – 4202921900 – 9% Duty

How technology supports customs classification

For retailers navigating the camping season, an effective classification system can save time and prevent costly errors.

At TariffTel, we have delved into the intricate terms associated with products, and designed our Item Types in our customs classification solution to be user-friendly. We eliminate the need for extensive research when classifying and reduce the risk of misclassification. This ensures your classification is accurate, done quickly and that you adhere to regulatory standards.

Want to understand more about classifying Summer products? Read our BBQ blog

Other Useful Resources

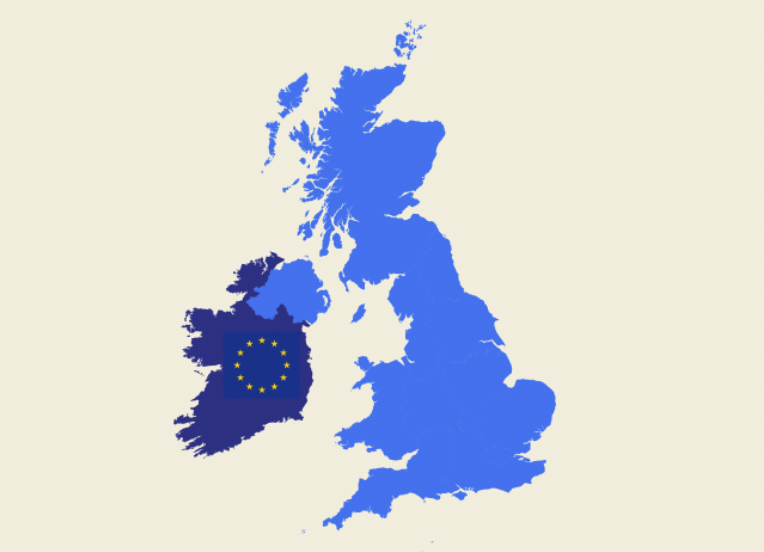

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...