Stop the spine tingles when classifying products this Halloween!

Topics

Celebrations for Halloween have got bigger and better than ever with Halloween spending in the UK estimated to total £777 million in 2023, up 13% from an estimated £687 million in 2022 and £607 million in 2021 (source: Finder.com).

There’s now a vast array of products that cater for this market from light-up costumes to spooky decorations and party food. Classifying some of these tricky products can give your classification team the spooks. With an accurate classification solution like TariffTel, backed by experts to navigate the more complex classifications, retailers can ensure their HS codes are correct and Halloween goods arrive in-store and on time to meet this growing consumer demand. This is exactly how our customer M&S ensures their Halloween products arrive in-store for consumers.

Here we take a look at some of the more spine-tingling products that can make assigning tariff codes at Halloween a bit of a classification headache.

What to look out for when classifying Halloween costumes

Costumes are by far the most sought-after product around Halloween. For kids and adults alike, there are now a vast range of clothing, costumes, and accessories of all kinds available.

The classification of Halloween costumes involves several key considerations. Firstly, it is essential to distinguish between true costumes and regular textile garments. There is a significant classification difference between the two, with costumes typically being made of non-durable materials not intended for prolonged or repeated use. For instance, a one-piece spider costume crafted from flimsy, non-durable material with visible raw edges at the neck, arms, and hem can fall under classification 9505. On the other hand, a clown costume, featuring a jumpsuit constructed from more durable, well-made material, would not meet this requirement, and would instead be categorised as fancy-dress clothing under chapters 61/62, depending on its construction.

The presence of additional items only adds to the complexities. Let’s take accessories like masks or a toy which is part of the costume. These can lead to a multi-tariff classification. For example, if the clown costume includes a mask made from non-durable material, it may be classified under 9505. However, items primarily designed as toys, like a toy mallet, would fall under heading 9503, as they serve a broader purpose and can be used year-round, not limited to the holiday season.

A crucial factor in determining the classification is whether the item is designed for year-round use or specific to Halloween. While a spooky design on a garment is a start, it is not sufficient to label it as a festive Halloween article. The durability and reusability aspects must also be considered. If a product is well-constructed with durable fabric or includes toys suitable for use throughout the year, its classification will typically fall outside of 9505.90.

For instance, consider this outfit from M&S, Although it features a spooky skeletal design on the top and bottom, it does not meet the requirements of a Halloween costume. The material is well-made and durable, and the outfit is not restricted to Halloween use, as it can serve as a comfortable pyjama set year-round.

Dastardly decorations

Halloween decorations present a complex challenge when it comes to classification due to specific guidelines governing what qualifies as a festive Halloween item. Take, for instance, ceramic items of various shapes and sizes that flood the market leading up to Halloween. Initially, you might assume that their design automatically categorises them as Halloween decorations. However, this assumption does not hold true. The first crucial distinction lies in determining whether a ceramic Halloween item serves a utilitarian or decorative purpose. For instance, this ceramic bowl adorned with Halloween-themed wording and motifs cannot be classified as a Halloween item under code 9505.90 since its primary function is utilitarian, meant for holding sweets and food, with decoration as a secondary aspect.

On the other hand, a product such as this decorative candle holder shaped like a carved, grinning pumpkin with other Halloween embellishments can be considered under code 9505.90. Its main purpose is decoration, representative of Halloween, with the candle’s role being to enhance its decorative appeal.

Using an automated classification system such as TariffTel can help alleviate these problems. TariffTel acts as a centralised hub in which all product data is conveniently held, and the system allows internal communication between retailer and suppliers. The TariffTel team also oversees the maintenance of your commodity codes, paying close attention to any Tariff Code changes, or changes to the interpretation of the Tariff, making sure the system remains up-to-date and accurate at all times.

Find out more about TariffTel and how it can support your business with classifying goods. Need support with classifying your products, get in touch with our team.

Other Useful Resources

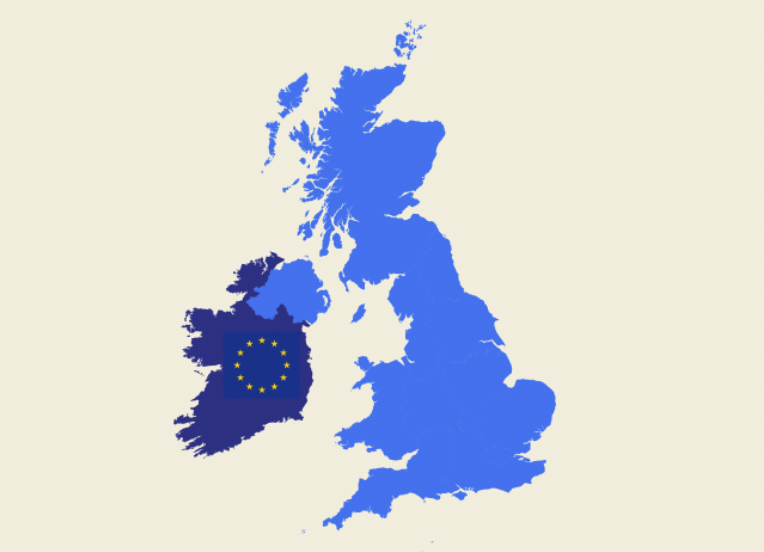

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...