Three common misconceptions about tariff codes

Topics

If you’re shipping goods internationally, your team are using tariff codes. The chances are many are incorrect and could be costing you money, in fact a staggering 2 out of every 5 tariff codes we test for customers are incorrect in our experience. Most business leaders aren’t aware their business is non-compliant and running the risk of misclassification.

Often, businesses take a ‘good-enough’ approach to classifying their products not realising that the use of incorrect tariff codes can cost huge amounts in overpaid duty or fines resulting from underpaid duty. Not only that, if your business is found by customs authorities to be using incorrect tariff codes, your shipments can potentially be held at borders, causing unnecessary disruption.

Here we look at 3 big misconceptions in the industry that exist today around tariff codes. We’re de-bunking myths and looking at how technology, like our TariffTel solution, can support businesses in classifying their goods accurately and compliantly, whilst removing some of the hurdles faced during the classification process.

Are you running the risk of incorrect codes?

Many management teams, operations and financial directors have decided it’s not worth it and are now reassessing the way their company classifies goods. They’re reconsidering the inadequate tools and manual processes their team currently uses and transforming their classification process to make incorrect codes a thing of the past. See how boohoo groups plc transformed their approach to classification with TariffTel recently .

Many senior teams have come to the conclusion that:

Many senior teams have come to the conclusion that:

1) Only by being fully compliant with trade regulations and procedures can a business be sure to safeguard against supply chain disruption including border delays and fines. Compliance comes with accurate tariff codes and to achieve this you need a precise customs classification solution to provide the highest standard in classification

2) The right customs solution can not only provide duty rate assurance, but free up time in the team to focus on growth and explore new trade opportunities

3) There’s a different solution to suit different needs – it’s important to invest in a system that grows as the business grows.

Misconception 1: No Consequences for misclassification

A common misconception is that misclassifying products with inaccurate tariff codes has minimal consequences.

In reality, using incorrect codes can lead to customs delays, fines, or even legal action. Customs authorities scrutinise tariff code accuracy, and errors can impact a company’s reputation and bottom line. It’s crucial for businesses to prioritise the correct classification of goods to avoid potential complications and significant financial risk.

Misclassifying goods may lead to these unexpected consequences if an importer is found non-compliant by the government.

- Repaying underpayments of duty – Underpayments of duty can lead to businesses having to repay the shortfall that should have been initially paid to customs authorities. This is often a meticulous and complex procedure that includes a thorough review of the misclassified products and the subsequent calculation of the correct tariff codes and associated duties, taking up both time and resource from elsewhere in the business. The financial impact of repaying underpayments extends beyond the actual duty amount. There are additional costs associated with conducting internal audits, hiring customs experts or consultants to rectify the misclassification, and possibly engaging legal support to navigate the complex regulatory landscape.

- Associated fines with noncompliance – Customs authorities take tariff code accuracy seriously, and any errors can result in penalties that can put strain on a company’s financial resources. These fines are not just nominal; they can escalate rapidly, especially if the misclassification is considered a deliberate attempt to evade duties.

- Potential loss of Authorized Economic Operator (AEO) status – AEO status is a coveted designation that provides companies with various benefits, including simplified customs procedures and reduced scrutiny. Losing this status could result in increased administrative burdens, longer processing times, and additional costs associated with adhering to standard customs procedures.

- Further audits to ensure future compliance – Following a misclassification of goods, businesses may find themselves subjected to further audits by government authorities to ensure future compliance with customs regulations. This means that customs authorities scrutinise a company’s import and export activities in-depth, aiming to identify any potential irregularities, errors, or intentional noncompliance. These audits typically involve a meticulous examination of the company’s documentation, including customs declarations, invoices, and other relevant records. The impact of these audits is significant. The company may incur additional costs associated with the preparation of documentation, engagement of specialised consultants, and potential legal expenses to navigate the audit process.

Misconception 2: Assuming one size fits all

Many companies run with the belief that a single tariff code can apply universally to a specific product.

In reality, tariff codes are highly detailed and specific, often requiring a thorough understanding of the product’s composition, intended use, and other factors. This is where human input and interpretation of the Harmonised System is vital and why AI tools can fail in assigning the correct code as they take a broad-brush approach to the rules, rather than considering every detail which affects the decision. Indeed, small variations to a product can affect classification and this nuance is often missed by AI tools which lack the knowledge and interpretive skill gained from the various sources of information involved in classification.

A good example of how this can affect duty costs is the US classification of a woman’s, knitted, cropped, blouse-like garment made using cotton. Many AI systems we have tested would classify this garment to heading 6106.10.0010, driving a duty of 19.7%. However, as the garment is cropped it is precluded from this heading, and instead would be classified to 6114.20.0010 where the duty is 10.8%, a notable 8.9% lower than the initial classification. This is the kind of interpretive work which is built into the TariffTel system, where our experienced team utilise not only the Tariff books, but also review the explanatory notes when assigning tariff codes taking into account various construction types and material combinations.

A good example of how this can affect duty costs is the US classification of a woman’s, knitted, cropped, blouse-like garment made using cotton. Many AI systems we have tested would classify this garment to heading 6106.10.0010, driving a duty of 19.7%. However, as the garment is cropped it is precluded from this heading, and instead would be classified to 6114.20.0010 where the duty is 10.8%, a notable 8.9% lower than the initial classification. This is the kind of interpretive work which is built into the TariffTel system, where our experienced team utilise not only the Tariff books, but also review the explanatory notes when assigning tariff codes taking into account various construction types and material combinations.

It’s also a common belief that once a tariff code is assigned to a product, it remains constant. However, tariff codes can change regularly due to updates in trade regulations, advancements in technology, or alterations in the product’s characteristics. Failing to regularly review and update tariff codes may lead to non-compliance and financial implications.

David James, Group Supply Chain Director, boohoo PLC, talks to the value of having expert knowledge when classifying, “The TariffTel team’s knowledge of the US classification system is unrivalled and without their team of experts and their TariffTel platform we would not have been able to classify the sheer volume of products we needed to ensure our new US distribution centre could start operating on time.”

Misconception 3: Tariff Codes only affect customs

Tariff codes only affect customs processes, right? Well actually…

Correct tariff classification is pivotal in global trade, as errors can trigger significant disruptions to the whole supply chain. When goods face inspection due to misclassification, the immediate consequences can include delivery delays, customer dissatisfaction, and financial losses. Holding costs rise as warehousing expenses accumulate during extended inspection periods, and this impacts the overall inventory efficiency in your business.

Tensions can arise with suppliers if there are production schedule disruptions, creating a ripple effect on the entire manufacturing process. The consequences of production schedule disruptions extend beyond just the immediate delays. Suppliers often operate on tight schedules, and any deviation from the agreed-upon timelines can strain the relationship. Delays can lead to increased carrying costs for suppliers, affecting their cash flow and overall operational efficiency. Tensions can intensify quickly and lead to challenges with supplier relationships.

Engaging your suppliers with classification can have many benefits, not just resulting in accurate tariff codes.

How TariffTel can support you

TariffTel provides the highest standard in customs classification. A unique system that works across your supply chain to provide unbeatable accuracy, duty rate assurance and cost savings. By leveraging the information already contained within your business and combining our customs experts’ industry knowledge, we offer unbeatable efficiency, accuracy, cost-savings and compliance standards in tariff code classification.

With TariffTel You can:

- Integrate crucial supplier data about your products and collate accurate product master data – this is unique to TariffTel and crucial for accurate classification. Unlike other solutions, TariffTel engages with suppliers to obtain very specific information including variations by product size, net weight, fabric composition, product images and other supporting documentation

- Keep up to date with changing tariff codes. TariffTel provides alerts and notifications the minute your HS codes change due to central updates – never be caught out again with out-dated codes

- Rely on accurate source data for a fully auditable trail. Often teams are faced with classifying items using poor and insufficient data, or relying on codes provided by suppliers. TariffTel enables the capture of relevant data at source and stores information in a centralised, secure data hub, with access to a full audit trail.

You can read more about TariffTel here. If you’d like to speak to an expert on our team please get in touch.

Other Useful Resources

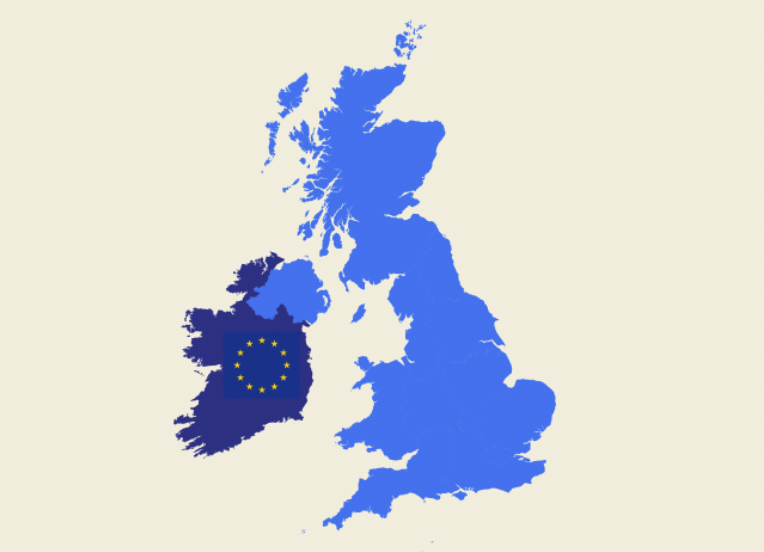

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...