Understanding classification complexities at Easter

Topics

At Easter, retailers have a great opportunity to capitalise on the sales of not only chocolate Easter eggs but increasingly Easter gifts.

Classifying Easter products for shipment can be challenging – when did you last see a simple round chocolate egg with nothing inside!? Today, Easter eggs take many shapes and sizes and come filled with toys, games and sweets. Whilst the end result is undoubtedly yummy…getting them on the shelves can pose a few challenges when it comes to classification.

Take this hollow chocolate carrot from our customer M&S, who uses TariffTel to classify products. The carrot is made from real gold leaf, interestingly, the gold leaf addition has no bearing on the classification of the product. However, the ingredient makeup is interesting, as the carrot itself is made from blonde chocolate (a form of white chocolate). From a classification perspective, it is not considered a chocolate of Chapter 18, as it does not contain cocoa. Despite this, the inclusion of ‘salted caramel chocolate bunny ears’, made from milk chocolate (containing cocoa), means that the product would be classified as a chocolate product under Chapter 18, based on Chapter Notes excluding confectionary containing cocoa from Chapter 17.

These delicious-looking chocolate hot cross buns filled with spices and orange peel present an interesting challenge as the description states that it is a chocolate hot cross bun egg “filled” with spices, raisins and orange jelly pieces. Within Heading 1806 – chocolate and other food preparations containing cocoa – there are different commodity codes based on whether a product is filled or not, however in this case, this product does not meet the requirements of being filled. The Explanatory Notes explain that “chocolate containing, for example, cereal, fruit or nuts (whether or not in pieces), embedded throughout the chocolate, are not regarded as “filled”.

Chocolate Easter egg hunts are all the rage at the moment and many retailers sell packs with all you need. Classifying these require a bit of thought. Take these buckets from M&S – a metal bucket containing sweets and chocolate. In this case, based on GRI 5 (b), a multi-tariff classification is required as the bucket would appear to be reusable rather than single use packaging. For the bucket, we must know the material prior to working on classification, the chocolates would be classified to Chapter 18, and the sweets (if they contain no cocoa), to Chapter 17.

Unlike the previous examples, in the case of hot cross buns and other bakers’ wares, the presence of cocoa would not move the classification from Heading 1905 to Chapter 18, as Heading 1905 includes these products whether they contain cocoa or not. However, we would have to determine the percentage, by weight, of sucrose within the product, as this would affect the classification at an 8/10-digit level.

During peak sales seasons such as Easter, it is vital your business is prepared for the complexities that classification can throw up. You never know what might come up each year, a gold leaf chocolate carrot is a new one on us! Whether you’re a growing business, or a larger enterprise, implementing an intuitive system like TariffTel for customs classifications can significantly reduce the time required to classify products and facilitate communication between vendors. This can mean the difference in getting the up-to-date information you need to classifying product quickly and compliantly.

If you have a question about classification, get in touch with our expert team who love a challenge!

Other Useful Resources

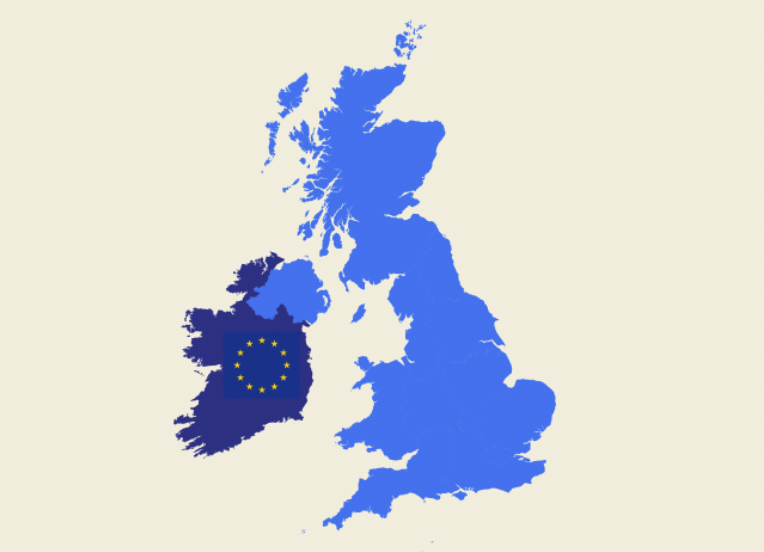

Windsor Framework update: Key details ahead of 1st May 2025 implementation

The Windsor Framework's latest updates come into effect on 1st May 2025, introducing new trading arrangements between Gr...

From spreadsheet chaos to smart compliance

Data accuracy matters more than you think in customs classification. In global trade, the difference between complian...

Adapting to an ever-changing regulatory environment

In the fast-moving world of international trade, compliance is more than just a legal necessity; it’s a competitive ad...