What’s the difference between a HS code and tariff code?

Topics

If your business ships products internationally, you’ll know that customs classification is a vital part of the process to ensure the smooth delivery of goods to their destination. Our innovative TariffTel solution supports businesses worldwide in doing just this, assigning the correct classification code every time, and it is used worldwide by businesses that ship anywhere from 100 to 100,000+ SKUs. Understanding this process is key to keeping trade moving across borders.

Here we explain the differences in some of the common terminology used in customs classification and when to use each code.

What is customs classification?

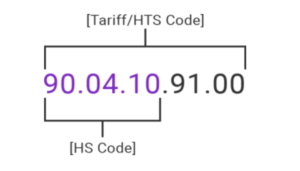

Put simply, customs classification refers to the process of assigning a code to a product that is to be imported or exported. This code is used to determine the tariff rates that apply to the goods, as well as to facilitate trade by enabling customs authorities to identify and track shipments. There are a few variations of a code you may see, including HS codes, HTS codes, and Tariff/Commodity Codes.

HS Codes

The Harmonised System (HS) is an internationally standardised system of names and numbers for classifying traded products. It was developed by the World Customs Organisation (WCO) and is used by more than 200 countries to assign HS codes. HS codes are six-digit codes that classify goods based on their nature, form, and composition. The first two digits of a HS code identify the chapter, the next two digits identify the heading, and the final two digits identify the subheading. Read more about HS codes.

HTS Codes

In the US, the Harmonised Tariff Schedule (HTS) is maintained by the U.S. International Trade Commission (USITC) and is used to determine the tariff rates that apply to goods imported into the United States. The WCO provides the first six digits and the HTSUS provides the final four for additional detail. Each country maintains its own Harmonised Tariff Schedule (or similarly named).

Tariff Codes/Commodity Codes

Tariff codes or commodity codes are classification codes used to determine the customs duty that is applied to a particular product. These codes are ten digits long for imports, eight digits for export, and are used to identify specific products. The HS code makes up the first six digits whilst the final four digits are unique to each country’s tariff system, and they provide additional detail that is specific to that country’s classification systems.

How to use the different codes

While there are several types of codes that are used for customs classification, they all serve the same purpose of allowing customs authorities to identify and track shipments, as well as determining the tariff rates that apply to those goods.

HS codes are the most widely used system for customs classification worldwide and provide the basis for the other codes under one global classification system. The HTS codes provide the final four digits within the US context and Tariff codes and Commodity codes are full classification codes used to determine the customs duty for specific products.

This visual helps explain what makes up a code:

As an importer or exporter, understanding the differences between these codes is crucial for navigating the complex world of international trade.

Whether you’re a growing business, or a larger enterprise, implementing an intuitive system like TariffTel for customs classifications can significantly reduce the time required to classify products and facilitates communication between vendors and suppliers meaning you get up-to-date information on the products you’re classifying. It also means your business is informed of HS code updates automatically.

If you want to find out more about HS codes or want to learn how your business could benefit from TariffTel, get in touch with our team.

Other Useful Resources

TariffTel is now ISO 27001 certified

Your product data, protected to the highest standard. We’ve achieved ISO/IEC 27001:2022 certification, the internat...

“We’ve always used this code. Why would we change it?”

That question is costing you more than you think. It sounds reasonable. The code worked last time. Your broke...

Why 2 out of every 5 tariff codes are typically wrong

And what it’s costing you... Tariff codes might look like a routine administrative step when you’re preparing goo...